More About Clark Wealth Partners

Table of ContentsThe Basic Principles Of Clark Wealth Partners Excitement About Clark Wealth PartnersClark Wealth Partners - TruthsLittle Known Facts About Clark Wealth Partners.The 3-Minute Rule for Clark Wealth PartnersThe Ultimate Guide To Clark Wealth PartnersThe Only Guide to Clark Wealth Partners9 Simple Techniques For Clark Wealth Partners

Whether your goal is to maximize life time offering, guarantee the care of a reliant, or assistance philanthropic causes, strategic tax obligation and estate preparation aids secure your heritage. Investing without a method is among the most common mistakes when constructing wealth. Without a clear strategy, you may catch stress marketing, frequent trading, or profile misalignment.I've attempted to mention some that imply something You really want a generalist (CFP) that may have an additional credential. The idea is to holistically look at what you're attempting to complete and all finance-related locations. Especially due to the fact that there might be tradeoffs. The CFP would certainly then refer you to or deal with legal representatives, accounting professionals, and so on.

The Facts About Clark Wealth Partners Uncovered

Also this is most likely on the phone, not personally, if that issues to you. compensations. (or a mix, "fee-based"). These coordinators are in component salesmen, for either investments or insurance coverage or both. I would certainly stay away yet some people fit with it - https://writeablog.net/clrkwlthprtnr/financial-advisors-illinois-trusted-guidance-for-your-financial-future. percentage-of-assets fee-only. These organizers obtain a fee from you, however as a percentage of financial investment properties managed.

There's a franchise Garrett Planning Network that has this kind of coordinator. There's an organization called NAPFA () for fiduciary non-commission-based planners.

3 Simple Techniques For Clark Wealth Partners

There have to do with 6 textbooks to dig via. You won't be a skilled professional at the end, however you'll understand a great deal. To obtain an actual CFP cert, you require 3 years experience in addition to the training courses and the exam - I haven't done that, simply guide knowing.

bonds. Those are one of the most vital investment choices.

The Clark Wealth Partners PDFs

No 2 individuals will have fairly the same collection of financial investment strategies or services. Relying on your goals in addition to your tolerance for risk and the moment you need to pursue those objectives, your advisor can help you identify a mix of financial investments that are ideal for you and created to assist you reach them.

Ally Financial institution, the company's direct look at this web-site financial subsidiary, offers a variety of down payment products and services. Credit report products are subject to approval and added terms and problems apply.

, is a subsidiary of Ally Financial Inc. The details had in this short article is supplied for general informative objectives and ought to not be understood as investment guidance, tax guidance, a solicitation or deal, or a referral to acquire or sell any type of protection.

The Only Guide to Clark Wealth Partners

Stocks items are andOptions include danger and are not ideal for all investors (retirement planning scott afb il). Evaluation the Characteristics and Risks of Standardized Alternatives sales brochure before you begin trading alternatives. Alternatives capitalists might lose the whole amount of their investment or more in a reasonably brief period of time. Trading on margin entails threat.

Clark Wealth Partners Fundamentals Explained

App Shop is a solution mark of Apple Inc. Ally and Do It Right are authorized solution marks of Ally Financial Inc.

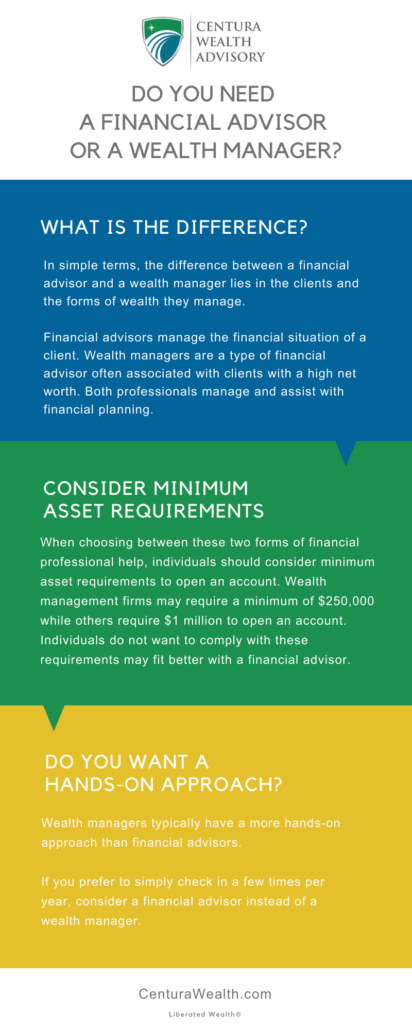

Handling your economic future can really feel overwhelming. With a lot of moving partsinvestments, retirement, tax approaches, threat management, and estate planningit's easy to really feel lost. That's where monetary experts and financial organizers come inguiding you via every choice. They can collaborate to help you strategy and stay on track to reach your goals, however their duties stand out.

How Clark Wealth Partners can Save You Time, Stress, and Money.

A monetary consultant aids keep you based in the daily, while an economic organizer guarantees your choices are based on long-lasting objectives. Financial advisors and financial organizers each bring various ability sets to the table.

Do you prepare to retire one day? These are all sensible and achievable economic goals. And that's why it may be a good idea to get some specialist assistance.

Everything about Clark Wealth Partners

While some consultants provide a variety of solutions, numerous specialize only in making and managing investments. A good consultant ought to have the ability to use assistance on every facet of your financial circumstance, though they might specialize in a specific location, like retired life planning or riches management. Ensure it's clear from the get-go what the price includes and whether they'll invest more time concentrating on any type of location.